Eight more advice firms join CCLA's sustainability group

City gears up for another long-distance cycle in support of Nick Hungerford charity

TAM’s James Penny: The market’s marching towards overheated territory – here’s how to play it Trustnet

‘Convenience comes at a cost’: Navigating the green bond landscape

Fund management's got talent

TAM Asset Management unveils fundraising activities in support of The Childhood Trust

How Tam Asset Management's CIO hunts down the next Terry Smith

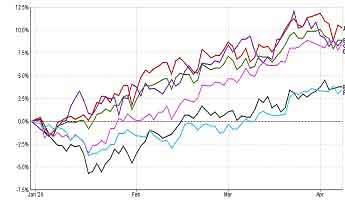

Wealth managers vs Vanguard Life Strategy: How the returns really stack up

Is now the time to hold gold?

TAM Asset Management CIO: Money market portfolios ‘enable advisers to maintain a relationship with clients’

Asset Managers Quietly Add ‘ESG’ to Portfolios of Defense Stocks

Deep Dive: Active ETFs are set to drive growth for the ETF industry

Wealth Manager Top 100 2023: The complete list of selection giants

Congratulations to TAM's CIO James Penny being included in the Citywire annual list of the UK's best asset managers for 2023.

My sharia portfolios outperform conventional investments

Brian Adams, Director of Lancashire-based advice firm Islamic Wealth Management, speaking to Citywire about our TAM Sharia model portfolio solution.

Benstead on Bonds: the bond crash has broken records – is it finally time to buy?

Why the FTSE 100 is closing in on 8000 - and where could it peak in 2023?

Torrid 2022 has created ‘a good entry point’ for European small caps

6th February 2023

How ETF investors are playing ‘the most anticipated recession of all time'

2nd December 2022

Meet the ESG Investment Influencers: James Penny of TAM Asset Management

In the latest in the ESG Investment Influencers series, Eve Maddock-Jones speaks to James Penny, chief investment officer of TAM Asset Management.

15th November 2022

Global Bond Yields Have Scope to Rise but Already Offer Opportunities, TAM AM Says

28th September 2022

Sterling currency crisis looms: Can the Bank of England steady the ship?

What was once a story about the pound depreciating due to a growing Fed-Bank of England policy divergence might have evolved into the early stages of a currency crisis, industry experts argue, as pressure for the UK central bank to hike rates mounts.

28th September 2022

‘Significant’ rate rise likely as GBP/USD heads towards parity

Sterling continued to flirt with record lows Wednesday as the Bank of England (BoE) eyes up a “significant” rate rise in response to chancellor Kwasi Kwarteng’s controversial mini-budget.

27th September 2022

Fund managers are sacrificing long-term gains for capital survival

27th September 2022

Is the UK in a currency crisis?

TAM Asset Management’s CIO reacts to the falling pound: “GBP looks very negative and will likely hit parity before Christmas”

2nd September 2022

Truss vs Sunak: Next PM risks fuelling inflation and spooking financial markets.

21st July 2022

Investment Week unveils finalists for Sustainable Investment Awards 2022

7th July 2022

Industry in 'wait and see' mode as UK outlook post-Boris looks cautiously optimistic

7th July 2022

Boris exit: implications for rates and taxes up in the air as race to find new PM begins.

28th June 2022

Shorting for ESG: Could liquid alternatives be part of the next wave of responsible investments?

The shortlists for the 2022 Investment Life & Pensions Moneyfacts Awards are...

26th May 2022

TAM Asset Management steps up climate commitment with carbon offsetting initiative.

4th May 2022

TAM Asset Management (TAM), the UK-based discretionary investment manager, has stepped up its commitment to combatting global warming by becoming one of the first discretionary fund managers to be awarded Carbon Neutral Plus status by Carbon Footprint Ltd.

TAM reduces carbon footprint with offsetting initiatives

4th may 2022

DFM collaborates with Carbon Footprint to offset client and business emissions TAM Asset Management has taken steps to reduce the carbon footprints of its business and clients through various offsetting projects.

Forward-thinking: A blessing or a curse?

2nd May 2022

A ‘technology push innovation’ is when you invent something and then hope people will want it. A ‘technology pull innovation’ is first figuring out what people want and then trying to invent it. The same concepts can be applied to the provision of investment services

THE ASIA PLAY

12th April 2022

Asian equities may seem best avoided at first glance with many headwinds hampering prospects for the region, but this is reflected in the price and, for many, the buy signals are there.

ESG Managers Skewer ‘Ridiculous’ Idea of Embracing Arms Stocks

10th April 2022

Defense lobbyists, as well as some analysts and bankers, have been discussing the merits of treating weapons as ESG assets.

ESG investors face extended period of underperformance

24th March 2022

Sustainable funds’ growth bias and aversion to the rallying oil & gas sector are likely to hinder returns over the next few years – but it isn’t all bad news for ethical investors.

Robust building blocks

14th March 2022

The existence of the traditional 60/40 model portfolio is being threatened as inflation continues to rear its ugly head, according to the chief investment officer of Tam Asset Management.

Finding value in ESG

7th March 2022

The start of 2022 has seen ESG investing arrive at a fork in the road.

Wealth managers on the best tech for sustainable portfolios

25th February 2022

Although we see progress, technology has limited scope as responsible investing has myriad considerations, many of which are difficult to quantify, weigh and compare. Thus, TAM integrates technology for insight into ESG factors in conjunction with our qualitative analysis.

Crypto’s Rising Role in the Asset Mix

23rd February

Why investors, corporations and high-net-worth clients are warming to crypto

Guards up: Four wealth managers’ top defensive fund picks.

21st February 2022

We asked professional fund buyers for their favourite funds to ride out volatility and inflation, with the classic ‘balanced’ portfolio increasingly failing to do the job.

Islamic mutual funds grow faster than global peers over last five years

16th February 2022

Islamic mutual funds grew faster than their global mutual fund counterparts over the last five years up to the end of Q3 2021.

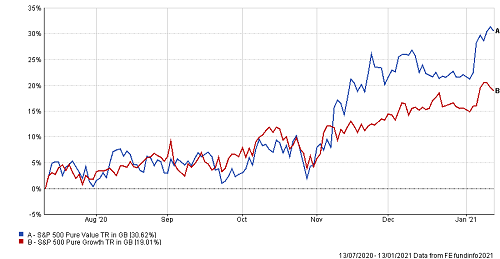

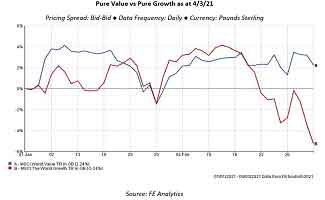

The value funds poised for a comeback.

14th February 2022

European financials, UK value and China are all “unloved” areas worth allocating to but they should also continue to back the likes of Terry Smith or Baillie Gifford, according to James Penny, UK chief investment officer at TAM Asset Management.

Is active management with passive pricing possible?

11th February 2022

Traditionally, the DNA of the average model portfolio still retains a mixture of funds and passive ETFs across fixed income and equities which give the investor diversification and some level of outperformance.

Oil’s rebound re-establishes energy stocks as long-term winners.

9th February 2022

Oil and gas giants BP and Shell both posted storming results for 2021, showing that oil has not been totally dismissed in a climate-conscious market just yet.

Will Year of the Tiger be a roaring success for China? Nine expert investors share their thoughts

31st January 2022

Despite the ongoing pessimism, nine investors discuss whether a roaring recovery is on the cards for the world’s engine of growth over the next 12 months and beyond.

Will the year of the tiger be a roaring success for China?

28th January 2022

We believe Chinese companies have strong growth prospects, but these may be missed if looking through a high-level macro lens only.

The top-ranked funds that are down double digits in 2022

13th January 2022

Morgan Stanley Global Insight, Baillie Gifford American and Morgan Stanley US Growth are some of the top-performing funds over five years that are down double-digits year-to-date.

Helping European advisers navigate ever-changing regulations

1st January 2022

We have been busy travelling around Europe throughout Q4 2021 in a quest to address advisers’ current regulatory headaches.

2022 may be a bull market – but not without volatility

24th December 2021

TAM chief investment officer looks back on a ‘rudderless’ year but is tentatively bullish on what lies ahead.

Revealed: All the winners at the 2021 PA Wealth Partnership Awards

1st December 2021

CIOs and fund managers keep their cool as renewed Covid restrictions bite

30th November 2021

Environment and Climate-Focused Funds Dominate ESG Investing

17th November 2021

Green Dream with TAM AM’s James Penny

2nd November 2021

Green Dream with TAM AM’s James Penny: We will see new asset classes emerge in ESG .

Natalie Kenway catches up with the CIO on client conversations, ESG pre and post-pandemic, and product choice.

The pricing tail does not wag the investment dog

November 2021

The pricing tail does not wag the investment dog: the true cost of a client investment

The importance of due diligence within ESG portfolios

1st Nov 2021

The investment team invests in different types of assets to diversify and reduce volatility

What's in a name? Too much data and a lack of standards complicate ESG fund analysis

28th Oct 2021

Learn what a global leader in actively managed bond funds can do for you

Watch what they say, not what they do

October 2021

We said in our last investment note, ‘We need to talk about volatility’, that despite relentless positivity in equity markets since the lows of March 2020, a growing number of institutional investors are feeling the need to take a more defensive orientation and have ‘insurance policies’, against the risk of markets retreating.

Grey cloud hangs over UK's role in EU financial services

October 2021

First it was fishing boats and now its submarines. The lates security pact between the US, UK and the Australians (AUKUS) has drawn my eye, once again, to the political body language between the UK and France.

You Give We Give: Tam Asset Management's Charity Initiative

14th October 2021

Seven years ago, Tam Asset Management set up its charitable initiative, You Give We Give. We caught up with Eric Williamson, investment manager at the firm, to see how the initiative is developing and what the future holds.

One, two, three:the present TAM investment stance

One, two, three:the present TAM investment stance

Lester Petch, CEO, TAM Europe Asset Management explains.

UN climate warning: eight things investors can do

12th August 2021

Many ethical investors are likely to have been pushed to the point where they think “it’s not enough to avoid oil and coal and buy renewables, I want to do more”. Reading about the UN’s climate change report and looking at some of photos of newly homeless families from wildfires and flooding in Greece, Turkey, Albania, Germany and California in recent days could be enough to lead ...

Podcast: ‘Sharia and ESG investing sing off the same hymn sheet’

5th August 2021

James Penny, CIO at Tam Asset Management, discusses the firm’s sharia portfolio offerings, the investible universe, and what actually makes an investment sharia-compliant.

Three things your clients may call you about this week ...

26th July 2021

Pension access, 'safe' funds and financial education - here's our weekly heads-up of articles in the weekend newspapers that may have caught your clients' attention... Savers seeking to keep early access to pension pots face 2023 deadline

Islamic finance in the UK

8th June 2021

The UK Islamic finance industry has developed progressively over the years. This has not been without challenges, and the impact of Brexit and the COVID-19 pandemic has created uncertainties. Like their conventional peers, the economic risks that Islamic banks share are similar, and the environment in which Islamic finance operates is expected to become smaller, particularly ...

3rd June 2021

Next Gen: Stephanie Sotiriou, TAM Asset Management

This week's Next Gen star is Stephanie Sotiriou, investment manager at TAM Asset Management. She discusses her father's influence on her career, her concerns around greenwashing, and her love of Cyprus!

The curse of knowledge.

1st June 2021

ESG, SRI and Impact Investing are terms we have recently become accustomed to hearing. But whilst we may now be familiarised with them, what do they actually mean? These three subsets are arguably enveloped within the same spectrum of "ethical investing".

We are a product of our environment.

1st May 2021

This is a well coined phrased used to describe wayward individuals, however, this acclaimed diagnosis does read true for a more diverse audience. The ESG market can certainly be categorised as such in Q1 of this year.

The value in diversification

1st April 2021

The UK began the year with its best investment returns in the first week or so ever recorded. This was in an environment in which the UK was still disentangling from the EU as Brexit is finally implemented - clarity is often all markets need. The US likewise moved higher but there are not so subtle shifts going on in market leaders and laggards.

Investing in bitcoin – a safe investment?

1st March 2021

Bitcoin is the best known of the 1,800-odd cryptocurrencies. Its meteoric rise has drawn many investors, with some believing that the underlying blockchain technology (blockchain is a digital ledger in which transactions made in cryptocurrencies are recorded chronologically and publicly) could become one of the most powerful tools ever given to civilisation.

Looking back at 2020

1st Jan 2021

Looking back on last year, professionally and personally, I think few would say it has been a forgettable one. The herculean strength in the stock market couldn’t stand in greater contrast to the very real pain being seen in households.

ESG training and professional development services

TAM has been in the ethical investing market for over 7 years and thrives on staying ahead of the curve when it comes to environmental, social and governance (ESG) investing.

Brexit…prepare for the worst and hope for the best

1st October 2020

TAM Asset Management provides an overview.

We await with bated breath, the lastminute negotiations between the UK and Europe as to how, if, and by what means, business in the Eurozone may be conducted with counterparties from the UK. The bizarre, no-one really knows situation, has resulted in multiple statements from the UK regulator and commen...

September 2020

WATERSHED MOMENT

Why the events of this timultaneous year could mean ESG investing ceases to be a thematic play, taking centre ground.

Revealed: The shortlists for the 2020 PA Wealth Partnership Awards

24th July 2020

Fund selectors from BMO Global, Brewin Dolphin, Morningstar, Premier Miton and Rathbones are all in the running to win the Fund Selection Team of the Year accolade in Portfolio Adviser’s inaugural Wealth Partnership Awards. The admittedly not-so-short shortlist for one of our centrepiece awards is completed by Apollo, EQ Investors, Financial Express, Investec, Quilter C...

UK asset manager opens Mallorca office

21st July 2020

The UK’s exit from the European Union was “arguably the catalyst” for London-based Tam Asset Management to open an office on the Balearic island of Mallorca, Lester Petch, European chief executive, told International Adviser.

The British manager TAM AM opens its first European office in Spain

16th July 2020

Good news for Spain in the process of attracting British entities in the context of Brexit. The manager TAM AM , specialized in discretionary management, registers its first European office in Spain. Specifically, the entity has just registered a securities agency (TAM Europe AM) based in Calvia (Mallorca).

FEIFA partners with TAM Asset Management in ESG drive

16th July 2020

FEIFA, the European trade association, has announced a new partnership with TAM Asset Management, an investment company that has operated across Europe for around 15 years.

5th June 2020

The shortlists for the 2020 Investment Life & Pensions Moneyfacts Awards are...

Tech Roundtable - The lessons of dotcom 20 years on

10th February 2020

FOLLOW THE FAANGS?

A handful of tech stocks account for a large proportion of the 10-year equities bull run. Can looking back to 2000 teach us anything about today?

Expert Investors: James Penny of TAM Asset Management

8th January 2020

Fund selection plays a crucial role in portfolio construction. Once the asset allocation decision has been made, these individuals need to decide how they want to be exposed, be it through a mutual fund, investment trust or ETF.

Seven wealth managers' top passive plays

18th November 2019

Despite the negative press active management has received off the back of the Woodford debacle, its presence in capital markets remains a core pillar when one considers the effect of long-term compounding returns and capital preservation capabilities from quality active managers over that of the index.

Try saving - don't pin hopes on the lottery

15th November 2019

How many of us, seeking an immediate change of fortune, have impulsively shelled out £2.50, crossed our fingers and bought a Lottery ticket in the hope of scooping a £155 million jackpot?

Investment uncovered

31st October 2019

Neil Jefferies, head of financial planning at Adroit Financial Planning, discusses DFM panels, the needs of clients and managed portfolios

How to avoid making a dog's dinner of your investments

27th September 2019

Browse through any weekday television guide and it soon becomes apparent that much of the nation must be obsessed with cookery programmes. They clutter the TV schedules like discarded junk consigned to the attic, yet some viewers must love them. Television companies adore them too because they're so cheap to produce - very few people get paid to appear on them.

How to avoid overpaying for underperfoming wealth talent

11th September 2019

A decade-long run of steady year-on-year increases in wealth management assets came to a shuddering halt in last year’s volatility, putting a far sharper focus on balance sheet discipline to sustain profitability.

Cash is no longer king - but we still need it!

2nd September 2019

News that around £1.5 billion-worth of old banknotes have yet to be redeemed more than a year after they ceased being legal tender will have encouraged many of us to take a second look at where we may have left a few ancient fivers. No joy? Me neither.

Frightened of investing? Don't be!

16th August 2019

I was in London last week where I met the chief executive of a firm with whom I've dealt for some time.

Long story short: she asked me to give a talk to a few hundred people at a forthcoming event, an invitation to which I agreed, perhaps a little too readily, because when the subject matter was revealed, it put me on the back foot. The topic on which I must speak for 15-20 minutes is:...

DIY pensions: why you can't rely on the state

9th August 2019

Indeed, the frequency with which WEF reports are issued, coupled with their often dizzying length, probably ensures that few are read cover-to-cover. Nevertheless, one of its recent publications, We'll Live to 100 - How Can We Afford It? proved unusually popular. Perhaps it was the snappy title.

The red flags signalling a fund manager may have lost it

9th July 2019

Are fund managers too big to fail? No. If they fall below market expectations, they shrink through natural sales.

Do you want to make saving simpler?

5th July 2019

If the internet age possesses a curse which blights us all, it's surely that we're frequently overwhelmed with too much information.

The red flags signalling a fund manager may have lost it

9th July 2019

Are fund managers too big to fail? No. If they fall below market expectations, they shrink through natural sales.

Are millennials spending too much money?

2nd July 2019

I'm indebted to research undertaken by Preston-based Profile Pensions which exposes, in the starkest possible detail, the enormous chasm between Millennials' monthly expenditure and the current state pension.

We've been nominated!

6th June 2019

We are delighted to announce that for the second consecutive year, TAM has been nominated for Best Ethical Discretionary Fund Manager at the Investment Life & Pensions Moneyfacts Awards.

And the good times keep on coming!

5th March 2019

We are absolutely delighted to tell you that TAM were named winners of the Award for Discretionary Wealth Management at last night's City of London Wealth Management Awards (COLWMA).

TAM has been nominated and the vote is now open!

4th February 2019

We are delighted to tell you that TAM have received two nominations at this year's City of London Wealth Management Awards (COLWMA).

Giving you more ways to access our award-winning investment portfolios

You may or not be aware that our Premier, Focus and Ethical investment portfolios are available across the Aviva and Transact Platforms.

The ninth fundraising strategy

The Charities Aid Foundation’s 2018 report found that while charitable donations may have risen in overall value, they’re coming from fewer people. This is a significant problem for the third sector. Raising money is hard enough when you’re one good cause amongst many – but it’s even harder when the number of potential donors is shrinking.

So how do you raise vital f...

TAM launches 'Through the Lens'

TAM are delighted to let you know that we have launched 'Through the Lens', a brand new video series capturing conversations with our award-winning investment management team as they share their market views and insight.

TAM's Triple Nomination for Professional Adviser Awards!

We are honoured to have received three nominations at the prestigious Professional Adviser Awards 2019.

TAM Group signs $200 million deal with international advisor VFS

We are delighted to inform you of an exciting development for the TAM Group in forming a strategic partnership with VFS International, winner of the International Investment Award for Best Best-Practice in Africa.

TAM nominated for Best Charity Partnership of the Year!

We are delighted to let you know that TAM has been nominated for Best Charity Partnership of the Year with our 'You Give, We Give' charitable giving initiative at the 2018 MoneyAge Awards.

The rise of the hybrid robo!

As a financial adviser, you’re all too aware of the threat posed by robo-advice platforms. But while you’re still offering higher-quality advice, and while you’re still retaining your key clients, there’s probably not much to worry about. Right? Wrong!

Alzheimer’s Research UK and Yorkshire Air Ambulance amongst new charities partnering with Greenfinch

Alzheimer’s Research UK, Blue Cross, DEBRA and Yorkshire Air Ambulance have each partnered with Greenfinch, our new non-advised investment platform providing charity members with access to expertly managed investment portfolios, whilst also giving them the opportunity to benefit their chosen charity in the process.

Greenfinch has flown the nest!

The Archway Project, Bobath Scotland, HEART UK - The Cholesterol Charity and Willow, have each partnered with Greenfinch - our new non-advised investment platform providing members with access to expertly managed discretionary investment portfolios, whilst also giving them the opportunity to benefit their chosen charity/ies in the process.

TAM nominated for Best Ethical Discretionary Fund Manager in 2018 Investment Life & Pensions Moneyfacts Awards!

We are thrilled to let you know that TAM has been nominated for 'Best Ethical Discretionary Fund Manager' - a new category at the 2018 Moneyfacts Investment Life & Pensions Awards. The annual Investment Life & Pensions Moneyfacts Awards ceremony is the pinnacle of the year’s product and service advocacy, continuing to grow year-on-year and attracting valuable acclaim. ...

How to compete with the robos

Dormant back books, full of clients who could no longer afford financial advice post-RDR are waiting to be reactivated. Until now this was an unprofitable proposition for IFAs, but the advent of automated investment solutions can help reactivate lost customers and attract new ones.

Over 30? What do you need for the rest of your life and how much will it cost?

Three advantages IFAs have over robo-advisors

IFAs don’t just have a place in the new world of low-cost, high-volume financial advice: they have several distinct advantages.

IFAs fight back!

If you’re an IFA, the rise of robo-advisers isn’t just a problem; it’s an existential threat. There’s a major gap in the post-RDR market for low-cost financial advice, and automated platforms have rushed to fill it.

Don't let your clients lose their ISA allowance

April 5th is fast approaching... beat the deadline!

FinchTech off to a flying start!

We are delighted to inform you that our non-advised digital investment management service, FinchTech Ltd, has launched! The plug-and-play white-labelled solution is one of the first of its kind and presents an opportunity to re-engage dormant clients potentially lost to the Retail Distribution Review (RDR), while simultaneously enabling IFAs to compete with the growing threat of low cost robo advice...

Give and gain: charitable investments that benefit Yorkshire Air Ambulance

TAM’s white label 'robo' proposition is a finalist!

FinchTech is up for Best New Entrant at the 10th annual Sustainable Investment Awards!

TAM Passive is here!

TAM are delighted to announce that in addition to our already diverse offering we have launched TAM Passive - a suite of low-cost passive investment portfolios which will be available in five risk profiles and actively managed by our award-winning investment team for just 0.15% AMC (exc. VAT).

TAM's magnificent eight: TAM's chosen funds take over fund manager awards

Last week on Thursday 6th July, the good and the great of the fund management industry came together in the Royal Albert Hall to celebrate outstanding achievement at the annual Fund Manager of the Year Awards hosted by Investment Week.

Lester Petch: Wake up IFAs – hybrid robos are on the march

To serve and protect: Protecting clients' wealth through turbulent times

'To Serve and Protect' is a phrase of singular simplicity coined by the LAPD in the 50’s to embody its mission statement. Since then, it has cemented itself as the cornerstone of US, and arguably global law enforcement.

So what’s a US law enforcement adage doing in an investment update to our clients?

Beat the deadline!

An ISA allows your client to benefit from tax free investment gains. After the 5th April 2017, investors will lose any of their £15,240 allowance which remains unused. With that day fast approaching, have your clients made the most of their 2016/17 allowance? There is still time to take advantage and TAM, as a regulated ISA manager, offer a variety of ways in which new and existing clients can bene...

We're delighted you still prefer us!

For the second year in a row, TAM have been named as a preferred DFM for a model portfolio service (MPS), according to Defaqto's 2017 annual DFM review of surveyed financial advisers. A huge thank you goes out to all that commended us, and if you haven't yet tried TAM for our Focus MPS, maybe now is the time...

TAM cuts fees for all clients

We are pleased to inform you that in our continued efforts to create the best value for investors, we are amending our fee structure to remove any minimum charges. This means that no matter how small a trade is in order to re-balance, adjust an asset allocation or make a withdrawal from a portfolio, the client will only be charged 1% of the trade value. This eradicates flat fees for our Focus, Ethical an...

The Pensions Regulator is coming... Don't get burnt by hefty fines!

With business owners now being penalised for not having a workplace pension scheme in place, The Pensions Regulator has been back on the road reminding employers that workplace pensions are the law and they are enforcing it! Confusion between employers and advisers in relation to auto-enrolment is no excuse.

Come and say hello at the Muslim Lifestyle Expo!

TAM Sharia at the Muslim Lifestyle Expo 2016

EVENT CITY | MANCHESTER | 29th - 30th OCTOBER

Active or passive: the right strategy for your firm and your clients

TAM awarded UK Asset Manager of the Year at the i-invest 2016 Asset Manager Awards!

We are delighted to announce that TAM Asset Management have been named 'UK Asset Manager of the Year' at the i-invest 2016 Asset Management Awards.

TAM's on Transact!

We are delighted to announce that our risk profiled Premier model investment portfolios are now available on the Transact Platform and can be used for new and existing Transact clients, where moving your clients over is as easy as a fund switch.

Sneak a Peek at TAM's New Look

TAM are delighted to announce that after many months of our clever developers busying away behind the scenes, we have at last launched our brand new website - cleaner, crisper and simpler

TAM Asset Management International named Best Investment Management Service provider

TAM Asset Management International was named Best Investment Management Service provider in the Wealth & Finance 2016 – Fund Manager Elite awards.

TAM Group signs $200 million deal with international advisor VFS

Don’t let your clients lose their ISA allowance

Hurry! There's not long left to make the most of your clients' 2015/2016 ISA allowance...

An individual savings account (ISA), allows savers to invest up to £15,240, tax free. Have your clients thought about this tax efficient way to save for their futures and if they already have an ISA, have they used their entire 2015...

You Give We Give raises over £20,000!

We are delighted to announce that thus far, our pioneering charitable giving scheme has raised over £20,000 for a variety of extremely worthy beneficiaries. This grand total is a combination of donations made to charities via the initiative, fundraising for the scheme's charity partners, and a boost from the HMRC Gift Aid scheme.

Give and get: the smart investment that benefits you and Alzheimer’s Research UK

In for a penny, in for a pound

2015 was all about the US dollar strengthening ahead of an anticipated interest rate hike which eventually came in December. All the major currencies weakened against the US dollar as a result and I had very few discussions about Sterling in particular, by which I mean from a Sterling perspective. This was because it didn’t really lose that much ground.

And the winner is...TAM International!

TAM International win Best Private Wealth Management Company

In November, we were delighted to tell you that TAM Asset Management were named winners of the 2015 Wealth and Finance International 'Award for Innovation in Portfolio Management - UK'. Today, we are thrilled and humbled to inform you that our subsidiary, TAM International, has been named 'Best Private Wealth Managem...

Thoughts from the CEO

Flat is the new up, and why the ‘pursuit of mediocrity’ is getting you absolutely nowhere.

Dawn of the Fed

“When you come to a fork in the road, take it” - Yogi Berra – Player / Manager, New York Yankees

So the big day has arrived (again) and we will later find out whether the US Federal Reserve is finally going to bite the bullet and raise interest rates

Getting Serious

From a fund management perspective there wasn't a whole lot to get excited about in Chancellor George Osborne’s Autumn Statement although an increase in the economic growth forecast, from 2.3% to 2.4% was welcome. UK Government bond yields rose on the news marginally reinforcing as it does the case for higher interest rates in the future.

TAM Finalists in Award for Innovation

TAM shortlisted for Award for Innovation second year in a row.

We are delighted to announce that TAM Asset Management and You Give We Give is a finalist for the Investment Week 'Award for Innovation' category in the 2015 Sustainable Investment Awards.

How IFAs can take advantage of the FCA robo review: play them at their own game

TAM Take Home Innovation Award

TAM Asset Management - Award for innovation in Portfolio Management - UK

We are thrilled to announce that TAM Asset Management has won the Wealth and Finance International 'Award for Innovation in Portfolio Management - UK' in the 2015 Finance Awards.

Message from the CEO

It ain't over 'til the fat lady sings

Markets appear to some to have hit a brick wall with the ongoing Greek tragedy, a Chinese devaluation and some minor growth fears being touted. This and Mr. Carneys call to Asset Managers to “check” they are set for market falls if interest rates go up, ensures that worries abound.<...

TAM Caters for Sharia Clients

TAM Asset Management offer clients an attractive selection of investment portfolios with funds that are compliant with the principles of Islam

FEATURES

- Multi-manager model portfolios

- Five risk profiles from defensive to adventurous

- Minimum investment £10,000 (or equivalent)

-&nbs...

TAM chosen as manager for new non-advised service offered by InvestingGreen

InvestingGreen, a trading style of InvestingWell Ltd, have chosen TAM Asset Management to bring socially responsible investors an online direct investment solution.

Tomorrow, on Thursday 25th June at Scottish Parliament, InvestingGreen will showcase a new non-advised proposition that allows customers to invest directly into one of TAM Ethical’s five model portfolios.

...

Investment Life & Pensions Moneyfacts Awards 2018 finalists revealed

Dream Team Conquer Paris to London

DAY THREE and the final push – Beauvais to Paris!

Two days ago, TAM's newly formed team of cyclists embarked on a 300 mile mission in the hope of raising vital funds for the ten You Give We Give charity partners.

We are thrilled to report that the cyclists have successfully completed the London to Paris bike ride and are all in one piece, alb...

You Give We Give à Paris

DAY TWO - Dieppe to Beauvais

We are so proud of the TAM team and associated members cycling from London to Paris. They have made it across the shores and are currently cycling through France. Today has been faced with some personal challenges within the team and certainly a tougher day.

You Give We Give à Paris

DAY ONE – London to Dieppe

Four TAM employees supported by other investment house representatives struck out for the French capital at 9.00am this morning from TAM’s Head Office in the City. A desperate attempt to catch the 17.30pm ferry to Dieppe was on!

You Give We Give à Paris

JUST ONE WEEK TO GO!

In 1 week today on Thursday 7th May, team TAM are cycling from London to Paris in the hope of raising £10,000 for the You Give We Give charity partners!

New Greenfinch platform helps charities benefit from people’s financial investments

You Give We Give à Paris

2 Weeks to go!

In 2 weeks today on Thursday 7th May, team TAM are cycling from London to Paris in the hope of raising £10,000 for the You Give We Give charity partners.

Lester Petch: Fighting 'bionic' robo - a closer look at the new breed

You Give We Give à Paris

4 weeks to go!

Team TAM and fabulous friends are swapping their desk chairs for bike saddles and cycling to Paris on Thursday 7th May to raise £10,000 for the ten terrific You Give We Give partner charities.

Markets were down but TAM still donate

Despite a volatile year in the markets, TAM’s positive portfolio performance meant there were still contributions towards the You Give We Give charitable donation scheme associated with TAM’s ethical investment product.

TAM Ethical and Virtuo Wealth welcome Impact Arts!

Impact Arts joins 5 other Scottish charities as chosen charity partners of the unique Scottish Charities ISA.

Founded in 1994, Impact Arts is a community arts charity and social enterprise and their mission is to help people change their lives through creativity and the arts. Impact Arts works across Scotland to build enlightened, healthy and economically vibrant communities and they believe that...

TAM Ethical to present at the 2015 ACIE annual conference

TAM Ethical have been selected as guest speakers to present at the annual Association of Charity Independent Examiners (ACIE) conference. The all-day event will be held on Thursday 12th March at The Wesley Hotel, Euston.

TAM Give More

TAM Ethical are increasing their contribution towards You Give We Give! Not only does this apply to all new clients, but also to all clients who have signed up to the scheme since it launched last year.

TAM Jump Starts January with Terrific Triple ISA Treat!

To welcome 2015, TAM are offering investors three brand spanking new ISA offers within three of their existing products

TAM’s Innovative Two!

Not one, but two, of TAM Ethical’s socially responsible products have been shortlisted for the highly sought after ‘Award for Innovation’ at the Investment Week Sustainable Investment Awards. The event will be held on Wednesday 26th November at Le Méridien Piccadilly in London.

Good Money Week 2014

For the second time this year, TAM Asset Management were selected as guest speakers to present their ethical proposition at the Standard Life Investments (SLI) ethical seminar. The event was held last month during the UK Sustainable Investment and Finance Association’s (UKSIF) annual campaign, ‘Good Money Week’, at 30 St Mary Axe – more popularly known as The Gherkin.

TAM’s One Two Three

Three ethical funds in which TAM Asset Management has invested, received first, second and third place in the Best Ethical Investment Provider category at the Moneyfacts Investment Life & Pensions Awards.

IFA targets lost RDR clients with white-label non-advised robo service

Lester Petch: What does the future look like for robo-advice?

x

Where are the best new sustainable or ethical investment opportunities?

TAM Ethical’s “YOU GIVE, WE GIVE” Cycling Team raise funds for Impact Arts

Where are the best new sustainable or ethical investment opportunities?

TAM Ethical’s “YOU GIVE, WE GIVE” Cycling Team raise funds for Impact Arts

Positive change: Three weeks in Asia with TAM Asset Management

TAM Ethical, the London-based investment management firm, has launched a new ISA offer for ethical investors.

50 shades of green

1st Feb 2021

What is Green investing for you? Reducing carbon emissions,halting global warming, improving social outcomes, enhancing good governance? Prof. Kevin Haines, BRC´s Head of Social Policy, asked this question in one of his Briefing Notes1. This is an excellent question, especially when there are potentially 50 shades of Green and any investor can find their own preferred personal hue.